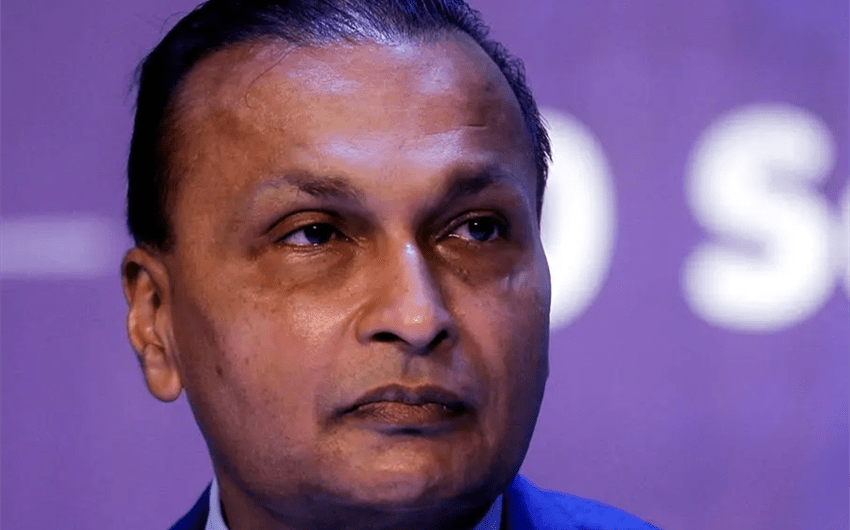

Anil Ambani’s Net Worth and the Rise, Fall, and Uncertain Future of a Business Tycoon

Anil Ambani’s net worth remains one of the most debated financial topics in global business because it represents one of the most dramatic wealth reversals in modern corporate history. Once celebrated as one of the world’s richest men, Anil Ambani was widely recognized as a powerhouse in telecom, infrastructure, finance, and entertainment. Today, however, his financial story has shifted dramatically, raising questions about his remaining wealth, liabilities, and future prospects. In this article, we explore the rise of Anil Ambani’s empire, the causes behind its collapse, and where his net worth stands today.

Anil Ambani’s Current Net Worth

Anil Ambani’s net worth is widely reported to be close to zero or in the negative, according to his own legal declarations. During court proceedings in the United Kingdom, he publicly stated that his net worth had been reduced to roughly zero and that he had no meaningful personal assets that could be liquidated to cover billions in debt obligations.

However, many analysts believe his financial picture is more complex. While his companies have collapsed under heavy debt, and several assets have been liquidated or taken over by lenders, some financial experts suggest that he may still retain indirect interests, family assets, or strategic holdings. Even so, compared to the multibillion-dollar empire he once commanded, Anil Ambani’s current wealth is a fraction of its former size.

The consensus remains clear: Anil Ambani, once worth more than $40 billion, has faced one of the largest personal financial collapses in modern history.

The Rise of a Billionaire: Early Beginnings and the Reliance Legacy

Anil Ambani was born into the house of India’s most influential business family. His father, Dhirubhai Ambani, founder of Reliance Industries, built an industrial empire that transformed India’s business landscape. After Dhirubhai’s passing in 2002, a well-publicized feud erupted between Anil and his elder brother, Mukesh Ambani, eventually leading to a split of the Reliance conglomerate.

Under the division, Mukesh took control of oil, gas, petrochemicals, and textiles, while Anil received telecom, finance, power, infrastructure, and entertainment divisions. At the time, both brothers appeared positioned for enormous success — and Anil Ambani began building his identity as a charismatic, ambitious leader ready to expand into fast-growing sectors.

During the mid-2000s, Anil’s star rose rapidly. He was celebrated for bringing innovation and modernization to India’s power and telecom sectors, and he became a regular feature on global billionaire lists. His entrepreneurial drive suggested he would rival his brother for decades to come.

The Peak of His Wealth

At the height of his success, Anil Ambani’s net worth was estimated at around $40 billion. This made him one of the richest individuals not only in India, but in the entire world. His companies were valued highly on the stock market, and investors poured money into his ambitious expansion plans.

Some of the flagship companies under the Anil Dhirubhai Ambani Group (ADAG) included:

- Reliance Communications (RCom) – telecommunications

- Reliance Capital – finance, insurance, mutual funds

- Reliance Power – electricity generation

- Reliance Infrastructure – construction, engineering, transportation

- Reliance Entertainment – media, movies, digital content

These businesses spanned multiple high-growth sectors, and many investors believed Anil was poised to become one of the most influential business leaders in India’s new economic era. For a short time, it appeared that his financial empire would stand alongside the largest corporate structures in Asia.

The Beginning of the Downfall

Anil Ambani’s financial decline began gradually and escalated over more than a decade. Several factors contributed to the collapse, including increasing competition, ambitious debt-driven expansions, regulatory changes, and strategic missteps.

1. Telecom Competition and the Fall of Reliance Communications

RCom was once a dominant player in India’s telecom sector, but intense competition and technological changes led to mounting losses. The introduction of new players with aggressive pricing models put tremendous pressure on RCom’s revenues. As the company struggled to upgrade infrastructure and convert its user base to newer technologies, its financial stability crumbled.

Eventually, RCom faced massive debt obligations and was forced into insolvency. This collapse triggered a chain reaction across Anil’s corporate group, as lenders sought recovery and other companies lost access to capital.

2. Reliance Power’s Struggles and Failed Mega Projects

Reliance Power was highly valued when it went public, but several of its ambitious projects faced delays, regulatory hurdles, and cost overruns. These setbacks prevented the company from delivering expected returns and contributed to further financial strain.

3. Infrastructure Investments and Mounting Debt

Anil Ambani’s strategy emphasized expansion through borrowing, which worked during boom periods but created enormous challenges when revenue slowed. Infrastructure, telecom, and energy projects require massive upfront capital, and as performance declined, lenders grew increasingly concerned about repayment.

This debt burden became the central reason behind the collapse of many ADAG companies.

4. Legal Battles and International Debt Disputes

The financial crisis surrounding Anil Ambani resulted in multiple lawsuits, arbitration cases, and regulatory disputes. Creditors sought repayment, government agencies investigated financial conduct, and courts demanded transparent asset declarations. As legal issues mounted, his public image shifted from that of a dynamic billionaire to a businessman facing one of the largest corporate crises in India’s history.

When Anil Ambani Declared He Was “Worth Zero”

In 2020, Anil Ambani appeared before a UK court for a case involving repayment of large debts. During the proceedings, he declared that his net worth had fallen to zero and that he had no significant personal assets left. This statement shocked the business world, as it marked a stunning contrast to the vast wealth he once controlled.

While such declarations are legally binding, financial experts remain divided on whether this fully reflects the complexity of his financial situation. Some believe he has access to family resources or indirect holdings that are not part of his personal income. Still, the legal and commercial evidence overwhelmingly shows a dramatic decline in his personal wealth.

What Remains of His Business Empire?

Today, most of the major ADAG companies have either collapsed, been significantly downsized, or entered insolvency processes. Key assets have been taken over by lenders, purchased by rival companies, or liquidated.

The remaining operations are limited compared to their earlier scale, and many no longer contribute meaningfully to Anil Ambani’s personal wealth. His business presence today is far more modest than it was during his peak years.

Does Anil Ambani Still Have Wealth?

While publicly declaring that he has no meaningful assets, there are several factors that create ambiguity around Anil Ambani’s actual financial standing:

- Family wealth: The broader Ambani family remains one of the richest in the world, and family structures sometimes obscure individual ownership.

- Private trusts or external holdings: High-net-worth families often use complex financial structures.

- Undisclosed investments: Some experts believe there may be private or international assets not fully accounted for.

Despite these possibilities, the transparent and legally disclosed picture shows a businessman whose empire collapsed under overwhelming debt, leaving him with minimal personal wealth by official accounts.

His Public Image and Media Attention

Anil Ambani’s transition from billionaire status to financial uncertainty has been heavily covered in global media. His downfall is frequently cited as one of the most dramatic examples of how rapidly fortunes can change in high-risk, debt-driven industries. His story is also contrasted with that of his brother, Mukesh Ambani, who continues to grow his wealth through diversified and stable business strategies.

Public curiosity around Anil Ambani’s net worth persists because of the sheer scale of the reversal and the unanswered questions surrounding the full extent of his financial resources.

Where His Financial Story Goes From Here

Anil Ambani’s future depends largely on how remaining legal battles resolve, how restructuring efforts unfold, and whether he reinvents himself through new ventures. Some business leaders have staged major comebacks after corporate collapses, but the scale of Ambani’s financial losses makes such a rebound challenging.

His experience may also serve as a lesson in the risks of rapid expansion, excessive debt, and high-stakes sectors that require continuous innovation and capital support.

Conclusion: Anil Ambani’s Net Worth Represents One of the Most Unprecedented Reversals in Business History

Anil Ambani’s net worth — which he has publicly described as essentially zero — reflects a story of extraordinary highs and dramatic lows. Once one of the world’s wealthiest individuals, he has seen his business empire decline under the weight of debt, competition, and regulatory challenges.

His financial journey stands as a powerful reminder of how volatile corporate fortunes can be, especially in industries driven by infrastructure, technology, and rapid expansion. While questions remain about the exact extent of his remaining wealth, the publicly documented picture shows a businessman who has experienced one of the most significant declines in net worth in modern times.

Whether Anil Ambani rebuilds his financial standing or remains focused on resolving past challenges, his story will continue to be studied by analysts, entrepreneurs, and historians for years to come.

image source: https://www.thehindubusinessline.com/companies/anil-ambani-moves-supreme-court-against-sbi-classification-of-his-account-as-fraud/article70345754.ece