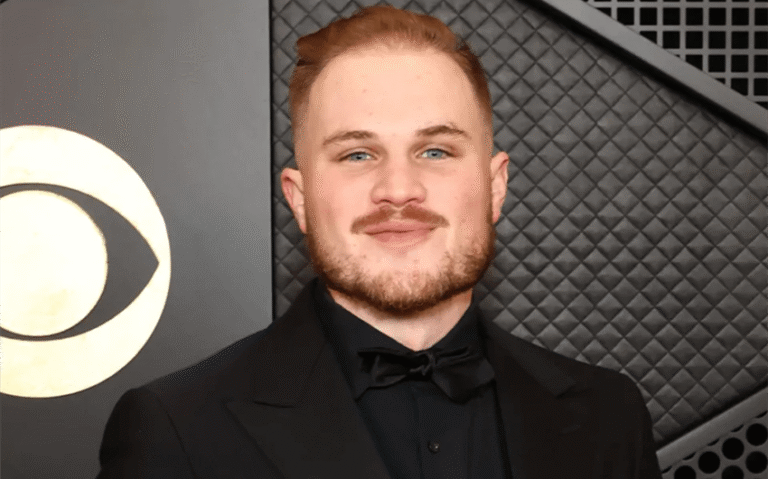

Ben Patrick Net Worth in 2026: Estimated Wealth and Income Breakdown Explained

Ben Patrick net worth is widely discussed in the low-millions, with most reasonable estimates landing around $2 million to $6 million. He doesn’t publish financial statements, so the exact number isn’t public—but his business model makes the “how” easy to understand: recurring coaching subscriptions, scalable digital products, equipment sales, and a personal brand strong enough to attract partnerships.

Who Is Ben Patrick?

Ben Patrick is a fitness coach and online creator best known as Knees Over Toes Guy, the educator who popularized joint-focused training for knees, ankles, hips, and overall athletic durability. His programs emphasize building strength through large ranges of motion, restoring capacity in neglected tissues (like the lower leg and anterior chain), and using simple tools (sled work, backward walking, tibialis training) to help people move better and feel better.

Over time, he turned that training philosophy into a business through Athletic Truth Group (ATG)—a coaching platform that delivers structured programs, progressions, and feedback systems for people who want results without guessing. That blend of a clear method plus a massive audience is what makes his earnings feel more like a “fitness company” than a typical influencer income story.

Estimated Net Worth

Estimated net worth in 2026: approximately $2 million to $6 million.

This range is a best-effort estimate based on the visible scale of his brand and the typical economics of subscription-based coaching businesses. Net worth is not the same as revenue. Even if a coaching platform generates strong monthly income, real net worth depends on what remains after:

- Payroll and contractor costs (coaches, support, operations)

- Platform and app development

- Payment processing, refunds, and customer service

- Marketing, content production, and ad spend

- Taxes and business reinvestment

With that in mind, the “low-millions” estimate makes sense for a creator-operator whose business is built around recurring subscriptions and a product ecosystem that can scale beyond one-to-one coaching.

Net Worth Breakdown

1) ATG subscription coaching as recurring revenue

The biggest engine behind Ben Patrick’s wealth is recurring income from ATG-style coaching subscriptions. This model is powerful because it’s predictable: instead of relying on one-time launches, the business can earn month after month as long as members stay enrolled.

Subscription coaching typically includes structured training plans, video instruction, progress tracking, and some form of coaching support or feedback. Even if the monthly price changes over time, the general concept stays the same: recurring payments + high perceived value (pain reduction, performance gains, better movement) can create a stable revenue base that compounds as the brand grows.

2) Digital programs and one-time training products

Most fitness coaching brands layer in one-time purchases—programs, templates, and “start here” bundles for people who want structure without a subscription. This category can be extremely profitable because it’s scalable: once the program is created, it can sell repeatedly without the same ongoing cost per customer as live coaching.

For Ben Patrick’s audience, these products also solve a real problem: many people want to try the method in a clear sequence before committing long-term. A well-built program becomes both a revenue stream and a funnel that converts satisfied customers into repeat buyers or subscribers.

3) Equipment and accessories linked to the training method

When a training style becomes popular, the tools that support it often become a business category of their own. Knee-friendly sled work, backward walking options, slant boards, tibialis tools, and other accessory items can create demand among followers who want to replicate the system at home.

Equipment sales can contribute to net worth in two ways: direct profit and brand stickiness. When someone buys the tools and uses them regularly, they’re more likely to stay connected to the programs, the community, and the coaching ecosystem.

4) Social media reach that continuously feeds the business

Ben Patrick’s content isn’t just “marketing.” It’s the product education layer that builds trust. His videos tend to demonstrate movements, show progressions, and make claims that feel testable—so viewers don’t just watch; they try it.

That matters financially because it lowers the cost of customer acquisition. When content consistently brings in new interested people, the business doesn’t have to rely only on paid ads. It can grow through attention, credibility, and community momentum—often the most durable way for a fitness brand to scale.

5) Sponsorships, affiliates, and brand partnerships

With a large, engaged audience in a clear niche (joint health, athletic resilience, mobility, performance longevity), sponsorship opportunities become more likely. Partnerships can include paid integrations, affiliate revenue on recommended products, and long-term brand relationships.

These deals can be high-margin compared to coaching because they often require less operational support. And when a creator has a highly trusted voice, partnership income can stack quickly—especially when it’s bundled into multi-post campaigns rather than one-off promotions.

6) Business equity and brand value as a long-term asset

Net worth isn’t only about yearly earnings—it’s also about the value of the business itself. A subscription-based coaching company with strong retention, a recognizable method, and a product ecosystem can become an asset with real enterprise value.

Even if Ben Patrick never sells the company, business equity still matters. It’s the “what this could be worth” layer that often separates creator income from founder wealth. The more the brand can operate with systems, staff, and product depth that don’t rely on one person doing everything, the more valuable it can become over time.

7) Why the estimate lands in the low-millions

Put the pieces together and the picture becomes clear: recurring subscriptions create steady cash flow, digital programs and equipment add scalable revenue, and social media keeps demand high without needing constant relaunches. Then you subtract the real costs of running a modern coaching business—team, platform, support, taxes, reinvestment—and you land in a “successful, low-millions” net worth range for a founder with a large audience and a proven product-market fit.

Featured Image Source: https://www.scmp.com/sport/outdoor/health-fitness/article/3137644/meet-kneesovertoesguy-social-media-health-and-fitness