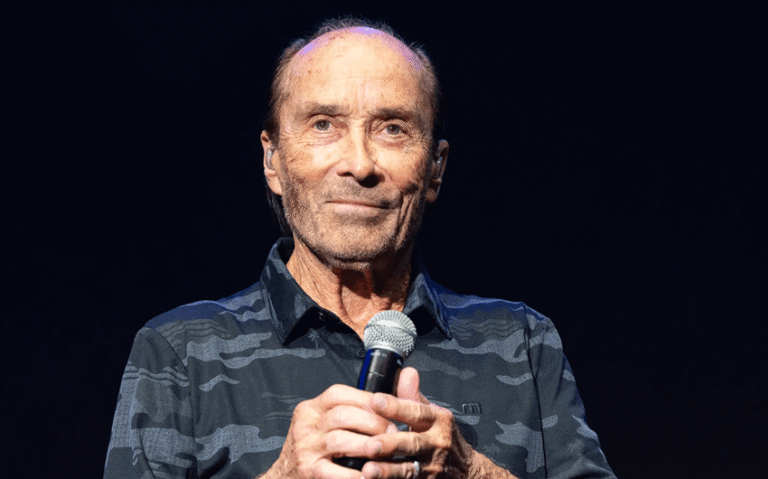

Cyrus Mistry Net Worth in 2026: Estimate and Main Wealth Sources Explained

Cyrus Mistry’s net worth is most often discussed in the context of the enormous family stake connected to Tata Sons. While personal finances aren’t publicly disclosed in a way that allows a precise figure, many widely repeated estimates placed him in the ultra-billionaire tier at the time of his death—driven far more by ownership stakes than by salary.

Who Is Cyrus Mistry?

Cyrus Pallonji Mistry (1968–2022) was an Irish-Indian businessman best known for serving as chairman of Tata Sons (and by extension the Tata Group) from 2012 to 2016. He came from the Mistry family, closely associated with the Shapoorji Pallonji Group, a major Indian construction and infrastructure conglomerate.

He became a global business headline not only because Tata is one of India’s most influential corporate groups, but also because of the high-profile corporate dispute that followed his removal as chairman. Even though his role at Tata was time-limited, the family’s long-standing minority ownership position in Tata Sons made him one of the world’s wealthiest business figures on paper.

Estimated Net Worth

Estimated net worth: often cited at roughly $29 billion (commonly reported around the time of his death).

That figure should be understood as an estimate tied to ownership stakes and valuation assumptions, not a verified personal balance sheet. In other words, it reflects what his stake and related family holdings could be worth under certain valuations—not necessarily what was liquid or easily cashable. Still, the recurring “tens of billions” estimate exists for a reason: the underlying asset base linked to the family’s stake has been viewed as extraordinarily valuable for years.

Net Worth Breakdown

1) Tata Sons minority stake (the largest driver)

The single biggest component behind Cyrus Mistry’s net worth estimates was the family’s minority stake in Tata Sons, the holding company that sits at the center of the Tata empire. Because Tata Sons is unlisted, the value of that stake is not determined by a daily stock price, which is why outside estimates can vary widely.

Even so, the logic is straightforward: if you hold a large slice of an entity that owns major positions in some of India’s most important companies, the implied value can be immense. This stake is the main reason he was often categorized among the world’s wealthiest individuals.

2) Shapoorji Pallonji Group assets and business interests

Another major contributor is the broader Shapoorji Pallonji Group ecosystem—construction, real estate development, infrastructure, engineering, and related businesses historically associated with the family. For high-net-worth families, these operating businesses can contribute wealth in two ways: annual cash flow and long-term enterprise value.

In practice, this part of the portfolio tends to be less “headline-friendly” than the Tata stake, but it can be highly meaningful because it includes real operating companies that generate revenue and hold assets over decades.

3) Valuation sensitivity (why the number can look huge)

Cyrus Mistry’s net worth estimates are unusually sensitive to valuation assumptions because the most important asset involved an unlisted holding company. Depending on the method used—comparable company multiples, implied value from Tata group holdings, or deal-based assumptions—analysts can land on very different figures.

This is a key reason you’ll see estimates ranging from “very high” to “astronomical.” When the underlying asset is massive and the pricing is not transparent, the resulting net worth figure becomes more of a modeled range than a fixed number.

4) Debt, pledges, and liquidity (what wealth looks like on the ground)

High net worth doesn’t always mean high liquidity. Large family stakes are sometimes pledged as collateral to raise financing, and the ability to sell an unlisted stake can be restricted by shareholder agreements, governance rules, or the practical challenge of finding a buyer at the desired valuation.

So while the net worth estimate can be staggering, the “spendable” portion at any given moment may be far smaller. This is common among ultra-wealthy families whose fortunes are concentrated in ownership stakes rather than cash or publicly traded shares.

5) Chairmanship compensation (small relative to ownership)

Although Cyrus Mistry held one of the most high-profile business positions in India, salary and executive compensation were not the primary drivers of his wealth story. At this tier, compensation is typically overshadowed by equity value. The chairmanship mattered for influence and visibility, but the stake-related asset base is what shaped the net worth conversation.

Featured Image Source: https://fortune.com/2022/09/04/cyrus-mistry-india-business-scion-dies-54/