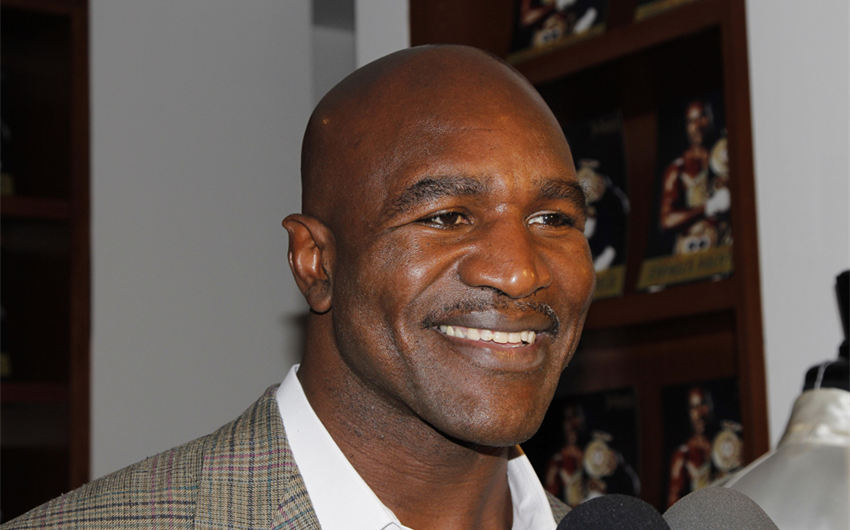

Evander Holyfield Net Worth in 2026: Estimate, Career, and Income Breakdown Explained

Evander Holyfield net worth is most often estimated at around $1 million, despite the fact he earned staggering money during his boxing peak. The reason the number looks “low” compared to his fame is simple: massive career income doesn’t automatically translate into lasting wealth when expenses, debts, and costly life events pile up. Here’s who he is, what his net worth is commonly estimated to be, and how the money flows in (and out).

Who Is Evander Holyfield?

Evander Holyfield is a retired American professional boxer nicknamed “The Real Deal,” widely regarded as one of the toughest champions in heavyweight history. He rose from an elite amateur background (including an Olympic bronze medal) into a Hall-of-Fame pro career built on conditioning, grit, and a willingness to fight anyone.

Holyfield is historically significant for two major achievements: he became the undisputed cruiserweight champion before moving up, and he later became a four-time heavyweight champion. He fought in some of the sport’s most memorable eras, facing legends like Mike Tyson, Lennox Lewis, George Foreman, and Riddick Bowe—matchups that helped define modern boxing’s big-pay-per-view era.

Estimated Net Worth

Estimated net worth in 2026: approximately $1 million (commonly cited).

This figure is best understood as an estimate of what he owns today minus what he owes—not a measure of what he earned at his peak. Holyfield’s career brought in enormous fight purses and event revenue across decades, but net worth can shrink quickly when a lifestyle grows faster than long-term planning, especially when big assets come with big carrying costs. In other words, it’s completely possible to earn “hundreds of millions” in a lifetime and still end up with a net worth that looks modest compared to the headlines.

Net Worth Breakdown

1) Boxing purses and pay-per-view money (the biggest lifetime earnings source)

The foundation of Holyfield’s wealth story starts in the ring. Heavyweight boxing in the late 1980s and 1990s produced massive paydays, and Holyfield was at the center of it. Championship fights, pay-per-view events, and high-profile rivalries are where elite boxers make generational money.

Even if you don’t know the exact profit split behind every event, the structure is clear: big fights generate revenue from tickets, pay-per-view buys, international rights, sponsorships, and closed-circuit distribution. Headliners earn the largest share, and Holyfield headlined plenty of them.

2) Endorsements and commercials (strong add-on income during peak fame)

When a boxer becomes a household name, brands want the association. Endorsements can include commercials, promotional appearances, and longer-term campaign deals. For Holyfield, endorsement money likely functioned as a strong “second paycheck” during the years when he was constantly in the public eye.

Endorsements matter for net worth because they can be high-margin income: you don’t have to take punches or absorb camp expenses to cash an endorsement check. The catch is that endorsement opportunities often fade when the spotlight dims—unless the athlete builds a durable business brand afterward.

3) Post-career exhibitions, appearances, and media work (ongoing but variable)

Many legendary fighters continue earning after retirement through autograph signings, speaking engagements, paid appearances, and occasional exhibitions. These can be meaningful, but they’re often inconsistent. A strong year might include multiple events and media projects; a quiet year might include very little beyond occasional bookings.

This category is important because it explains how income can continue even after prime athletic years end—especially for a fighter whose name remains recognizable worldwide.

4) Business ventures and investments (potential upside, mixed results)

Like many high-earning athletes, Holyfield has been connected to business ventures and investments over the years. In theory, this is the smart move: use athletic income to buy assets that keep producing money long after retirement. Real estate, brand licensing, and private ventures can all play that role.

The reality, though, is that athlete investing is a high-variance game. Some investments grow into stable wealth; others underperform or fail. Without full public financial disclosures, you can’t audit which ventures were winners versus losses—but business activity is still part of the overall picture when people discuss how his wealth was built and how it changed over time.

5) Real estate costs and major lifestyle expenses (where wealth can disappear fast)

Holyfield’s finances are frequently discussed alongside the story of his extremely large Atlanta-area mansion and the enormous costs of maintaining a property on that scale. Big homes aren’t just “assets.” They’re also expensive machines that burn money through maintenance, staffing, utilities, insurance, repairs, and upgrades.

When carrying costs are high, a home can behave less like a wealth-builder and more like a wealth-drainer—especially if income becomes uneven later in life. This is one of the clearest examples of how a superstar can earn a fortune and still feel financial pressure years later.

6) Family obligations, legal costs, and taxes (the hidden drain on take-home wealth)

Net worth isn’t only about what you make—it’s also about what you keep. For high-profile athletes, major drains can include divorce settlements, legal fees, ongoing family obligations, and tax issues. Even when each individual cost seems manageable compared to a championship paycheck, the cumulative effect over decades can be enormous.

This category is often the least glamorous, but it’s one of the most powerful explanations for why an athlete’s estimated net worth can look surprisingly small compared to their lifetime earnings.

7) Legacy income: licensing, memorabilia, and brand value (steady, not explosive)

Finally, there’s legacy income. Legendary athletes can earn from licensing their name or likeness, memorabilia demand, and brand-related opportunities that exist simply because the public still remembers them. This kind of money is usually steadier than it is massive, but it can help support long-term financial stability when paired with sensible spending and investing.