Tyreek Hill Net Worth in 2026: Estimate, Salary, Contracts, and Wealth Breakdown

Tyreek Hill net worth gets attention because he’s combined elite on-field production with elite paydays. While his exact finances aren’t public, his contract values and career earnings are well documented, which makes it easier to form a realistic estimate. The widely reported figure sits in the tens of millions, powered mainly by NFL contracts and reinforced by endorsements and business activity.

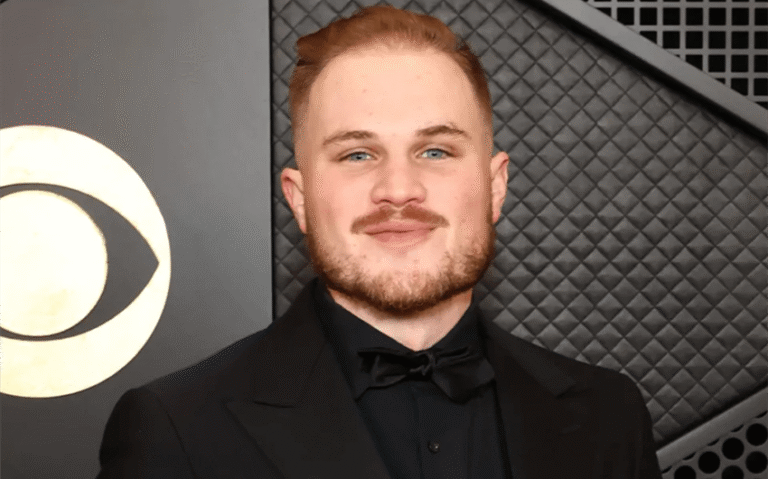

Who Is Tyreek Hill?

Tyreek Hill is an NFL wide receiver known for game-breaking speed and big-play production. He entered the league in 2016, became a star with the Kansas City Chiefs, and later continued his top-tier performance with the Miami Dolphins. Over his career, he has earned a reputation as one of the league’s most dangerous offensive weapons and has remained a centerpiece of high-powered passing attacks.

Estimated Net Worth

Tyreek Hill’s net worth is most commonly estimated at around $60 million. Think of this as a practical public benchmark rather than a precise accounting. Net worth isn’t the same as contract totals, because taxes, agent fees, training costs, lifestyle spending, and investment choices all affect how much of an athlete’s earnings turn into lasting wealth.

Net Worth Breakdown

1) NFL contracts and guaranteed money (the main driver)

The biggest factor in Hill’s wealth is straightforward: contract cash flow. In the NFL, the details that matter most are signing bonuses, guaranteed money, and how compensation is structured year to year. When a player is paid at the top of the market, that creates the kind of income that can rapidly build net worth—especially when it’s backed by guarantees and paid out in large chunks.

Even without getting lost in technicalities, the takeaway is simple: Hill has been paid like a franchise-level star, and those earnings form the foundation of his estimated net worth.

2) Career earnings (a scale indicator, not the same as wealth)

Career earnings totals help explain why his net worth estimate is so high, but they’re not the same thing as what he “has.” An athlete can earn well over $100 million during a career and still end up with a much lower net worth once taxes, expenses, and spending are accounted for. Still, large career earnings provide the raw material for wealth—especially when a player turns a meaningful portion of that money into long-term assets.

For high earners like Hill, the gap between “earned” and “kept” is where financial discipline matters most.

3) Endorsements and sponsorships (the second income engine)

Endorsements can add significant money on top of NFL salary, particularly for a player with wide name recognition. Brand deals can include athletic apparel partnerships, local and national sponsorships, social media campaigns, and paid appearances. The specific dollar amounts are often private, but the general impact is clear: endorsement income can be easier to invest and diversify because it’s not tied to the physical wear-and-tear of playing seasons.

For an elite player, this stream can range from “nice extra income” to “serious wealth builder,” depending on how many deals exist and how long they last.

4) Business ventures and equity opportunities (where net worth can grow fastest)

The difference between a high salary and a high net worth is often ownership. Athletes who move beyond endorsements into equity—owning a stake in a company or investing early—can grow wealth much faster than salary alone would allow. Hill has been linked to business activity and partnerships beyond football, which matters because equity can appreciate over time.

These deals are also one reason public net worth estimates vary. Outsiders can sometimes see that a partnership exists, but they usually can’t see the size of the stake, the valuation, or the long-term payout potential.

5) What can move the estimate up or down

Even with big contracts, net worth can swing based on real-world factors:

Taxes and fees: Top-tier NFL income is heavily taxed, and agents and management take a share, reducing take-home pay.

Asset strategy: Real estate, diversified investing, and business ownership can strengthen net worth over time, while overspending can erode it.

Timing of cash flow: A contract headline number can be enormous, but net worth depends on what is actually paid out and retained after expenses.